Imagine for a second you are financially free.

You don’t have to wake up to an alarm, you don’t have to go to work, you can just take a random Tuesday off. What if you could wake up tomorrow and think, truly think, “I can do whatever I want to do today.”

This is having “F U” money, and researchers around the world say this is the peak point of lasting happiness from money1-3. Money really can “buy” happiness (to this point).

“F U” money, in more polite terms, is your Freedom Number, or the amount of money that if it hit your bank account every month, you would never have to worry about earning money again. The money that covers all your life’s expenses.

Hitting my freedom number let me quit a job that was draining me, and now I’m the happiest I’ve ever been in my entire life. Why hitting this number is so powerful for me is that it allows me to focus on what truly matters to me. Telling everything else to F off.

Importantly, we want to set a number that hits financial freedom but is also “enough.” One of the quickest ways to misery is to become stuck on the Hedonic Treadmill or constantly running after “more,” creating stress, fatigue, and, eventually, unhappiness.

First, we are going to figure out what your freedom number is and why you want to hit it.

Second, we are going to discuss specific ways to actually hit your freedom number, including investments, a classic 9-5, and entrepreneurship.

Third, we are going to create a plan on how to actually take action by scheduling a freedom path, changing your daily inputs, and applying 80/20.

Find your freedom Number

Why do you want to be financially free?

What’s the point of your life? Have you thought about a vision? Why do you want this money? Money is just paper or metal, and money is now 92% bits on a computer. And it only has value because society has all agreed it has value.

So, if you are happy and safe living in the forest and off the land without needing to buy anything, you don’t need any money, so your freedom number is $0/month. If you live in a place like NYC, your freedom number might be closer to $8,000/month because you need to exchange something of value to other people so you can have shelter, food, and heat. What is the point of having money for you?

So, when I was 16, I began to do crazy things on the internet so I would never have to “worry” about money again, like selling stuff on eBay, blogging, or trying to become a sponsored gamer (none of them worked). It wasn’t until 10 years later that I could actually earn enough money every month to cover my living expenses so that I could “quit” or not have to work a 9-5 ever again from making YouTube videos.

So, let’s get down to it: how do you calculate this number? Well, my “freedom number” was and is $5,000 a month because that’s how much money I need to pay rent and bills ($2,000), food and essentials ($1,000), travel and do fun activities ($1,000), and save/invest/buffer ($1,000).

So, essentially, the freedom number is calculated by seeing how much money you need to live every month in your comfortable lifestyle. Now, importantly, you could, of course, decrease or increase the cost of your lifestyle, and then the freedom number would change.

Simply:

- Calculate your monthly living expenses—everything from rent to groceries to entertainment.

- Multiply that by 12 to get your annual expenses.

- Add a buffer (I choose 20-25%) for unexpected costs or inflation.

So if your rent is $1,500, food is $500, fun and travel is $500, and a buffer is $500, your freedom number would be $3,000 a month. If somehow $3,000 were deposited in your bank account every month, congrats, you are free! As long as your cost of living doesn’t increase, you can do whatever you want for the rest of your life!

Now, this isn’t financial advice, but many finance professionals recommend having an Emergency fund (6-12 months of expenses) as a buffer. So, say you are getting that $3,000 a month into your bank account. Many of these professionals would recommend, before you go off into the sunset, you store $18,000 – $36,000 in a place that can be easily made liquid (like a bank account as opposed to real estate) in case that $3,000 disappears or something pops up, like a health emergency, that requires a lot of money.

So how do we actually make this money so we can be free?

Ways to Make Money

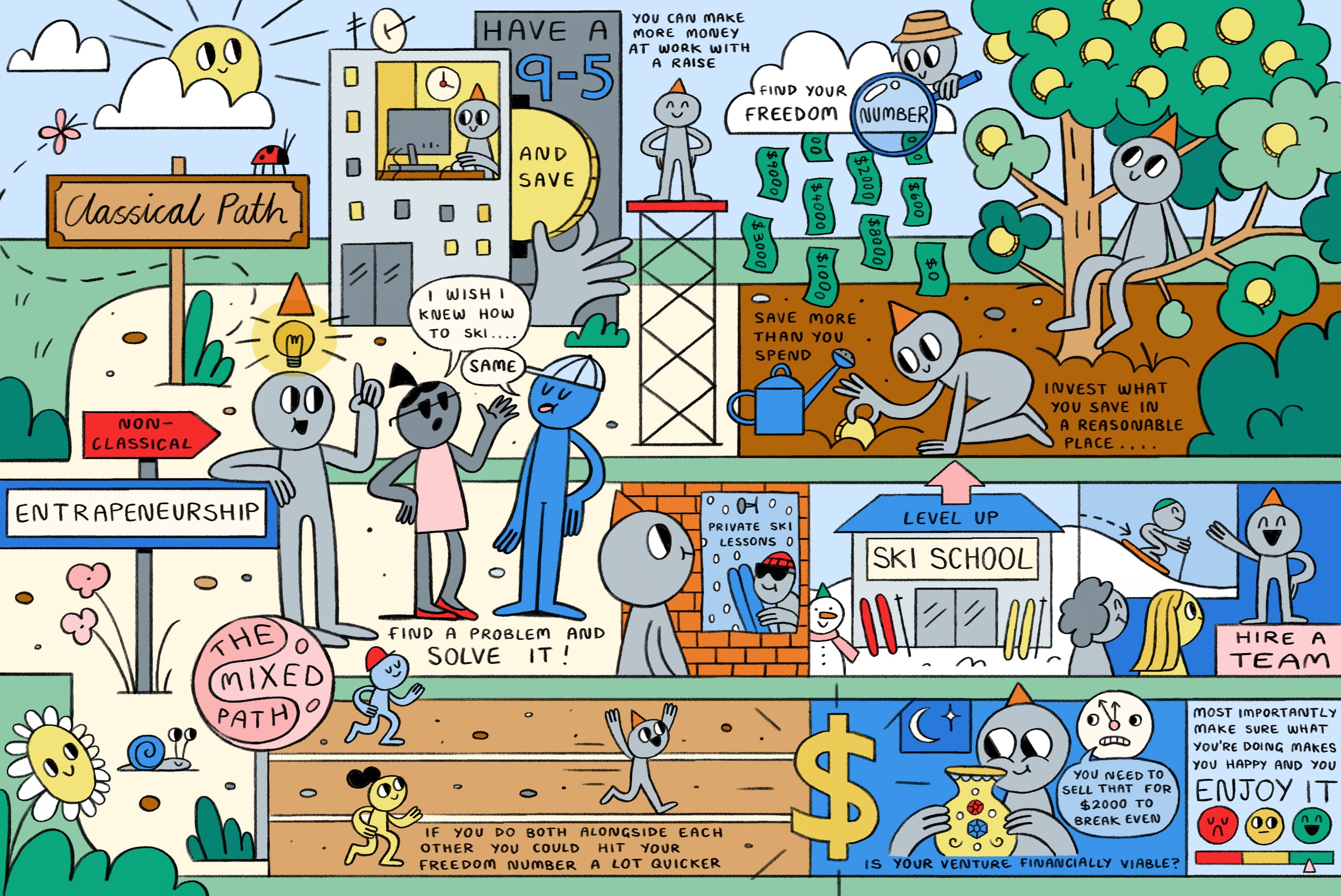

There are essentially three paths: the classical path (such as a job), the non-classical path (such as entrepreneurship), or a mix of the two (such as a side gig with a 9-5).

Now, for the sake of this video, we will ignore personal fulfillment and actual life enjoyment at the job or entrepreneurship or whatever. But, I definitely do not think it is wise to only consider money. In fact, for me, the non-money part of work or entrepreneurship and my energy from whatever I am doing or the energy suck from things that I don’t want to be doing is more important to me than the money. But I still like money…

Classical Path (job)

The classical path is where you have a 9-5 job and save enough money to hit your freedom number through the rule that you can live off of savings and investments yearly (the idea being that if the market returns 10% on average if you take 4% out of your investments every year, 95% of the time there will still be money left over in 30 years, I’ll show you an example shortly).

Importantly, your monthly salary does not contribute to that freedom number if you want to quit your job one day or if you want to have “F U” money, so you are ok if you are fired or lose the job for some reason. But, if you are seriously fulfilled in your job, want to do it for the foreseeable future, and the paycheck hits your freedom number, congratulations, you are free!

But, if you want to quit your job one day or accumulate “F U” money, with the classical path, there are really only two options to accelerate this process:

- Make more money at work by switching jobs or getting a raise at the current one

- Save more money by spending less at home (rent, food, and other expenses)

So, for example, if your freedom number is $1,500 a month if you have $500,000 invested in a place like an index fund that, on average, returns 10% every year, you are free because you can withdraw 4% every year and the remaining 6% will cover inflation and market fluctuation over time:

- 4% of $500,000 = $20,000

- $20,000 / 12 months = ~$1,500 / month

How do you get to $500,000 saved? That’s a big number! Well, say you earn $100,000 a year. If you save $50,000 of that (which would be difficult), after 10 years, you would be financially free because $50,000 x 10 = $500,000.

There are some great books that talk about this, but I’ll summarize all of them in one sentence: save more than you spend and invest what you save in a reasonable place.

For example, The Simple Path to Wealth, which is a good book about to this path, says to save 50% of your money, invest it all in an index fund, and you will be financially free. Other books like this are Richer, Wiser, Happier, and the Millionaire Next Door.

Overall, on the classical path, you would work a 9-5, pay off any debt, save up an emergency fund, max out tax-friendly investments, and then try to hit that investment amount of 25x your yearly expenses. Again, this is not investing advice, just summarizing what the above books recommend.

Non-classical Path (Entrepreneurship)

Ok, my favorite path! The non-classical path or entrepreneurship. My dream was to be able to never have to work a 9-5 and have “F U” money, and that was all made possible by this path!

Say you have a website that sells a language course that teaches beginners how to learn Spanish. You charge people $100 for your course. If your freedom number is $3,000, when you sell 30 of your courses every month, you are free!

That’s exactly what the non-classical path is, where you can make enough money to live on, hitting your freedom number, through something that is not a job.

Of course, with more entrepreneurial ventures, the money might not be as consistent, which is why I, like you, might feel more comfortable saving a year’s worth of an emergency fund before leaving the “classical” job.

But at the same time, also consider that if you went from working part-time on a project and it hit your freedom number to working on it full time, do you think the success of that project would increase or decrease?

I always loved the internet and the idea of financial freedom. When I was 13 years old I saw someone making millions reselling clothing and I was hooked. I tinkered half-assidly with blogs, poker, dropshipping, reselling, and a couple of other things for the next 10 years. I had my brain split in a million different directions. But, the whole time, I was half-assing it, so I got half-assed results. One day in my 20s after college, however, I decided I wanted to commit to one thing in a real way for a year because I was disappointed in my distracted mind and my achievements up to this point. That thing happened to be YouTube, and it changed my life.

After three years of it, I had hit my freedom number. I was financially free! I had “F U” money, it was amazing!! I left my classical job, and I’m the happiest I’ve ever been.

Now, of course, I had an insane amount of luck in getting to where I am. I’m not saying YouTube is the only path (However, if you do want to learn about making money with a YouTube channel, I have an e-book I’ll attach in a link, which is my free 99 YouTube Secrets Black Book that outlines everything I did to get here).

What I am saying is the real change to my outputs came when I committed to my inputs.

I get weekly emails from people asking about how to make money online, start a YT channel, or start a business. They are convinced there is a hidden path that every successful person on the internet is working together to hide from them when, in reality, there is no such thing.

The real issue these people have is they are stuck in analysis paralysis. They are addicted to thinking about it (like I was for 2 years before I started my YouTube channel) and treat this like a hobby instead of a real commitment.

What they really need to do, like I needed to do, is just take one action step forward. One simple step.

So, for all those people, no more excuses! I’m going to outline it for you right now. If there is a “secret path,” this would be it. It is heavily inspired by a great podcast by Ali Abdaal with Daniel Priestley, who lays out everything you need to start a business.

Essentially, you have to find a problem and solve it for the first time or solve it better than other people have solved it. I’ve broken down his outline into 10 steps:

- Identify Your Origin Story: Reflect on your background and experiences to determine what aligns with your passions and strengths. If you were looking at you from the outside in, what kind of things would you be focused on building? What problems would you be solving? Do you know a lot about writing, or went to school for medicine, or were a professional Skiier at some point in your life?

- Define Your Vision and Mission: Envision the future you desire and establish a mission that excites you. This clarity will guide your decisions and actions as you develop your business. No holds barred here, what is the thing you dream on working on? What do you always think about in your free time?

- Generate and Test Ideas: Brainstorm at least ten ideas that solve real problems people are willing to pay for. Select the top three and test them quickly and inexpensively through methods like introductory events, quizzes, or forming interest groups. This could even be messaging friends and seeing if they would pay for the thing.

- Engage with Potential Customers: Conduct conversations or interviews with at least 30 potential customers to gather feedback. This will help you refine your product and pitch and understand the market demand.

- Develop a Compelling Offer: Create a clear and attractive offer based on the feedback received. Ensure it addresses the needs and desires of your target audience effectively.

- Focus on Sales and Marketing: Implement a structured sales process, including lead generation, setting appointments, presenting your product, and closing sales. Consistent effort in these areas is crucial for building momentum.

- Establish Yourself as a Key Person of Influence: Position yourself as an authority in your industry by sharing valuable content, speaking at events, and building a personal brand. This increases credibility and attracts opportunities.

- Build a Supportive Team: As your business grows, assemble a team that complements your skills and shares your vision. Look for individuals who bring diverse perspectives and strengths to the table.

- Develop Scalable Assets: Invest in creating assets such as intellectual property, media content, and technology that can scale your business operations and reach. These assets enhance efficiency and value.

- Maintain Curiosity and Resilience: Approach challenges with curiosity and view criticism as an opportunity to learn. Staying adaptable and resilient is key to navigating the entrepreneurial journey.

Now, if you’re like me, when you read this kinda post, you are like, “Ok okayyyy the theory is nice and good, but just tell me what to make. I need specific ideas! Here are 5 ideas that are easy to get started with:

- Content creation (easy to start, hard to do well): YouTube, blogs, podcasts, or newsletters about topics that interest you, and you can make money through advertisements, affiliate links, and sponsorships. Or combine it with one of the products below.

- Physical product E-commerce (failed for me): starting your own online store and selling a physical product that you make and manufacture yourself or buy at a lower price from a wholesaler and then selling it to customers at a higher price. Things like supplements, clothing, or water bottles.

- Service Business (a great entry point): Freelancing on things like graphic design, video editing, cleaning, photography, music production, commissioned art, consulting, or coaching. Places to look for work are Upwork, Fiverr, PeoplePerHour, Freelancer, or Toptal. You could also do teaching, tutoring, test prep, or language instruction.

- Software as a Service (hard): develop an app or subscription-based tech tool that solves a specific problem. To do it alone, you’ll need to know everything from coding to sales and marketing.

- Informational Digital Products (medium difficulty): sell an e-book, a template, stock media, or an online course.

Importantly, it doesn’t have to be just one of the above, but I recommend only starting with one.

Maybe you are a great skier and can teach private lessons on the weekend outside of your 9-5. Then, after you’ve proven that people like to learn from you and you’ve done ok with it, maybe you level up by opening a skiing school or a Skiing website or a skiing app where you aren’t limited to teaching one person at a time.

Then, you hire a team and teach them your theory on teaching skiing, spending most of your time just training the team, improving the website or app, and growing the business. That’s the great thing about starting a business: you can do it yourself and adapt, change, and grow!

Some great books to learn about the entrepreneurial path, all of which changed my life, are:

- The Millionaire Fast Lane (my favorite one)

- The 4-Hour Workweek

- Rich Dad Poor Dad

- Million Dollar Weekend

Starting a business is hard, but it’s really fun. You create something you care about, there is no specific path to take so you have to grow, adapt, and learn on the fly. You can fail miserably (like I did many times) or succeed crazily. There are so many options out there. You likely won’t succeed at first, but try again! I tried for 12 years!

Now, committing to this full-time and not having a normal job can be stressful and risky. Personally, it felt too risky for me, which is why I did it part-time while I was still in school and then while I was working a normal job.

I followed the mixed path.

Mixed Path

The mixed path is where you still work your 9-5 but dedicate as much time as reasonable to the entrepreneurial path in your free time. I liked this path for three main reasons:

- I didn’t want to wait 10-30 years working at a 9-5 to hit my freedom number from wages. This gave me the opportunity to hit the number much more quickly.

- I had less risk because I was simply trying the entrepreneurial path in my free time. If I failed, I always had the classical job to fall back on.

- I really enjoyed trying out new business ideas on the internet; it felt like a play to me!

Ok, let’s come back to the goal, which is to hit our freedom number so we can wake up in the morning and do whatever we want for the rest of our lives.

Ok, so we’ve at this point:

- Identified our Freedom Number

- Selected a path to pursue

Now, we actually have to pursue the path. This is the most important and, of course, the hardest part.

How to Take Action

Let’s say you pick a non-classical opportunity to make money. The next step is seeing if this path is a reasonable way to hit your freedom number.

For example, say you make pottery and it takes you 20 hours to make a vase that you sell for $130 for a $100 profit after tax, and your freedom number is $3,000.

That means, per month, you would need to make 30 vases ($100 x 30 = $3,000), or about a vase a day. However, each vase takes 20 hours, which means you only have 4 hours to spend on sleep, a job, your family, and other parts of life. This venture isn’t reasonable! You would need to either increase prices, make other things, hire people (which we don’t want to do at the beginning), or reduce the time you spend making each vase.

Now, what if you sold an ebook for $110 with $100 of profit? That means you would need to sell just one of those a day or 30 a month. And, after you make the book, there is no additional work other than maybe marketing. If the book is great, it will sell itself! You just set up a sales page on one of the sites listed before, and voila, you have hit your freedom number!

That seems much more reasonable, right? And possible?

Now, here is where my advice breaks from the norm. Instead of simply saying, ok, my goal is to make $3,000 a month, a much better goal, after you’ve selected a reasonable product, is to try to hit certain inputs or action instead of dollars in a bank account.

For example, if I started from scratch and wanted to hit my number again, I might try it with digital products in this way over a year:

- Read five books on making money with business, writing, and the internet in 1 months.

- Decide on my niche and what content my products will be based around in 1 month.

- Make three products over 3 months.

- Market the three products over 1 month (one week each)

- Select one of those three products and double down on it with marketing, sales, and promotion or even another version of the product (6 months).

- At the end of the year, assess and see if I need to pivot.

In the freelancing option, it might look something like this:

- Month 1: decide on the skill I will be freelancing out

- Month 2: read three books on freelancing, the skill I will be using to freelance, and marketing myself online

- Month 3: Posting my services on Upwork, People For Hire, and Fiverr at an extremely low rate.

- Month 4-6: Learning what I like or dislike about the work I am doing and improve my skills through practice

- Month 7: Decide on a real rate that could actually allow me to hit my freedom number while working on it part-time (If I work 20 hours a week, that would be around $40/hr).

- Month 8-12: Reposition myself on freelance websites with new and improved experience and skills and aim to hit my freedom number.

Then, at the beginning of my Freedom Number Adventure, I would split my first task into weeks and set reasonable weekly goals per task for inputs (for example, maybe week one of my Digital Product plan is reading this one specific book, like The Millionaire Fast Lane, week 2 is reading 4-hour workweek, and so on). Finally, I would dedicate 10-20 hours a week to accomplishing those goals in my off time while working a full-time job.

Then, after the year, if I make absolutely no money or am seriously drained by this work, I might pivot to another business. Importantly, I want to make sure I make the proper attempt because I’ve taken these business attempts way too casually. When I committed, like the plan above, it changed my life.

Summary

Ok, so, overall, if I was starting over with $0 in my bank account and working a 9-5, what would I do to hit my freedom number again?:

- Figure out what my monthly number is and why I want to hit it.

- Decide whether I want to take the classical, non-classical, or mixed path to hit that number (I would choose mixed)

- Pick one business to try wholeheartedly for an entire year and focus on my inputs into the system as opposed to the outputs (creating 5 SaaS products as opposed to making $1,000 a month).

- Dedicate 10-20 hours a week, probably 90 minutes in the mornings and 5-10 hours total on the weekends, to completing my input goals.

- Reevaluate yearly (80/20) and schedule my overall tasks quarterly (12 week year), try to constantly learn new things about what I’m trying to make money in (daily reading, podcasts, or videos in that area that I am trying to make money in), invest my money to pay myself first in the form of education or learning new business-relevant skills, then pay off debt, then invest in tax-friendly options (like a 401k and Roth IRA), then invest pretty much everything else using dollar-cost averaging (investing ~once a month to reduce variance) into an index fund like VTI.

Finally, all of this is pointless if the action of doing these things makes you extremely unhappy or stressed. The whole point of trying to hit this freedom number is to give you more free time and headspace to increase your time spent on personal priorities and decrease your time spent on your non-priorities.

I am so thankful to all of you who watch my videos and buy my products because it’s you who have allowed me to live the most memorable and happy times of my life. Taking action consistently and having a growth mindset is the quickest way to level up in life. Buy the book. Take the course. Launch the website. Put yourself out there. Don’t be disheartened when you hit a roadblock or fail or someone says something nasty to you. Instead, realize they are all opportunities for you to learn and grow. If I quit the first time, someone said my voice was funny or my jokes were bad, oh boy…

Thanks for reading!

Zach

Work Cited

- Kahneman, D., & Deaton, A. (2010). High income improves evaluation of life but not emotional well-being. Proceedings of the National Academy of Sciences, 107(38), 16489–16493.

- Schwartz, B. (2004). The Paradox of Choice: Why More Is Less. HarperCollins.

- Di Tella, R., Haisken-De New, J., & MacCulloch, R. (2010). Happiness adaptation to income and to status in an individual panel. Journal of Economic Behavior & Organization, 76(3), 834–852.